To align with the latest recommendations by the Financial Action Task Force, a global transnational body regulating anti-money laundering and counter-terrorist financing (AML / CTF) standards, the Anti-Money Laundering and Counter Terrorist Financing (Amendment) Ordinance 2022, which came into operation on 1 June 2023, introduces, among other amendments, the following 2 new licensing regimes:

(i) a 2-tier registration regime for dealers in precious metals and stones (DPMS); and

(ii) a licensing regime for virtual asset service providers (VASP).

If you’re a VASP operating before 1 June 2023, hurry up as your deadline to apply for a license is 29 February 2024!

In this edition of the bowers.law Room 228 Newsletter, we will highlight the requirements and obligations under these two licensing regimes which now form part of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance, Cap. 615 (AMLO).

Hong Kong Registration Regime for DPMS which took effect on 1 April 2023

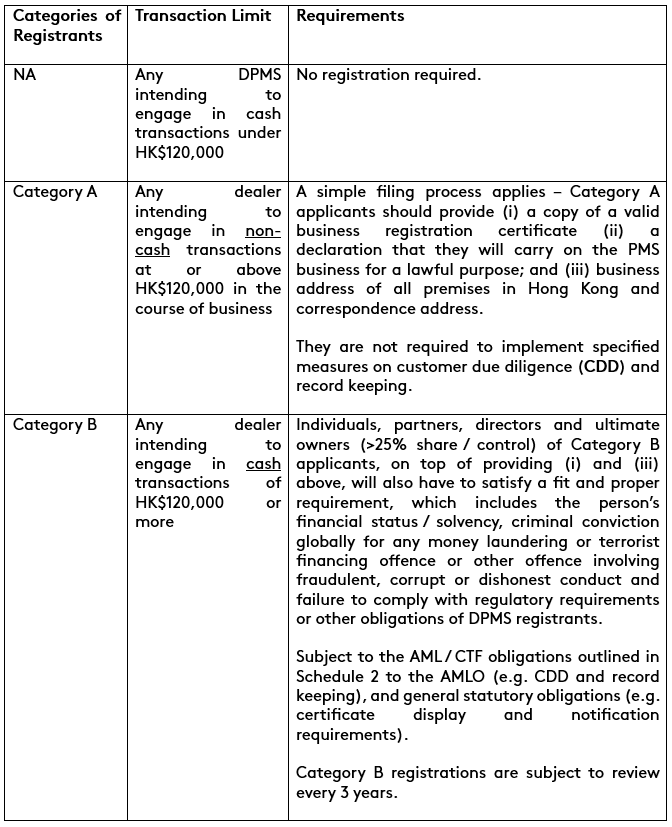

Anyone intending to conduct business dealing in precious metals and stones (PMS) in Hong Kong must now be registered with the Commissioner of Customs and Excise under the following regime which came into force on 1 April 2023. Any non-registered person who carries out transaction(s) with total value at or above HK$120,000 in Hong Kong is subject to a maximum penalty of a HK$100,000 fine and 6 months’ imprisonment. Below is a summary of the registration requirements for different categories of transaction limits / transaction types:

Hong Kong Licensing Regime for VASP which took effect on 1 June 2023

The VASP Licensing Regime commenced on 1 June 2023. The Guidelines for Virtual Asset Trading Platform Operators published by the Securities and Futures Commission (SFC) set out in detail the following requirements a VA exchange (as defined under section 53ZR and Schedule 3B to the AMLO) must fulfil when providing VA services in Hong Kong:

- Licensed exchanges are required to maintain adequate financial resources, including minimum paid-up share capital of HK$5,000,000 and minimum liquid capital of HK$3,000,000 or liquid assets equivalent to at least 12 months of actual operating expenses.

- Client assets, including virtual assets and fiat currency, must be held on trust for the benefit of clients by a subsidiary with a Trust and Company Service Provider license and cannot be on-lent, pledged, mortgaged or invested. At least 98% of client virtual assets must be in cold storage (such as Hardware Security Module (HSM)-based cold storage). Cryptographic seeds and private keys should be securely stored in Hong Kong. If the exchange becomes insolvent, client assets will be ring-fenced such that they will not be available to general creditors. A compensation arrangement approved by the SFC must be in place.

- Proprietary trading is restricted except for off-platform back-to-back transactions or otherwise permitted by the SFC. Non-prefunded trades and lending, algorithmic trading and derivatives are prohibited. Only certain well-established crypto assets can be offered to retail customers. Depending on retail customers’ KYC / risk profile based on their financial situation, investment experience and objectives, corresponding trading limits may be imposed.

- The licensed exchange, its officers (including at least 2 responsible officers (ROs), licensed representatives (LRs) and directors) and the ultimate beneficial owner must be “fit and proper”. The criteria in determining whether a person is “fit and proper” includes their financial status, education and other qualifications / experience, ability to act competently, honestly and fairly, and good reputation, character, reliability and financial integrity.

- The licensed exchange is required to maintain adequate AML / CTF policies, procedures and controls – which means developing strong written policies and procedures for risk-based customer due diligence at onboarding, periodically and on trigger events, name screening, sanctions compliance, transaction monitoring and record keeping (of not less than 7 years). The controls are expected to satisfy the travel rule which requires that certain information relating to the originator and beneficiary of a transaction to be submitted.

- The licensed exchange is subject to various guidelines covering ongoing compliance requirements across operations, market integrity, custody, senior management oversight, cybersecurity, conflicts of interest, record keeping and audits.

- When applying for a VASP license, the applicant is required to engage an external assessor to assess its policies, procedures, systems and controls; and submit the assessor’s reports to the SFC (i) when submitting the license application (Phase 1 Report) and (ii) after approval-in-principle is granted (Phase 2 Report).

A transitional arrangement is in place for a VA exchange to be deemed licensed if it was providing a VA Service immediately before 1 June 2023. It must confirm that it will comply with and have arrangements in place to comply with the regulatory requirements under the VASP Licensing Regime upon being deemed licensed and lodge a compliant application to the SFC for a VASP license by 29 February 2024. This requirement is only satisfied once the SFC acknowledges receipt of the application. There are similar deeming provisions for the LRs and ROs of these corporate applicants.

bowers.law will be pleased to assist precious metals and stones dealers / virtual asset platform operators with their licence applications.

Please contact Kevin or Derek at kevin.bowers@bowers.law or derek.cheuk@bowers.law if you have any questions about this Room 228 Newsletter.

This Newsletter is not intended to be and should not be relied on as legal advice. You should seek professional legal advice before taking any action in relation to the subject-matter of this Newsletter.