Why do employees commit fraud?

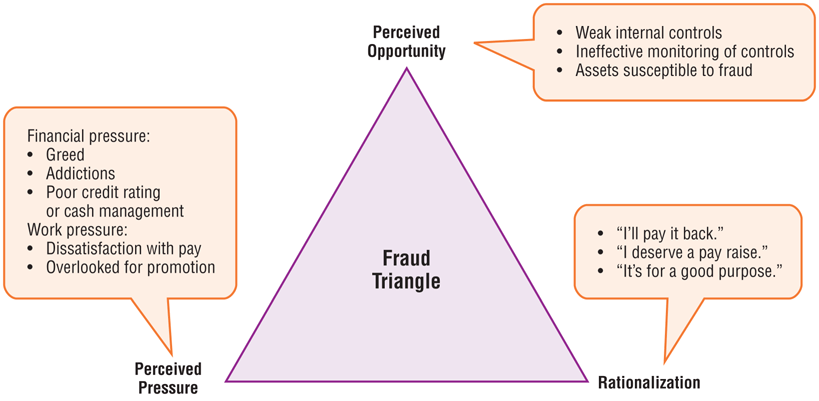

The Fraud Triangle explains why employees commit fraud and steal from their employers.

There are three primary drivers behind employee fraud – each of which is exacerbated during the Covid-19 global pandemic, which means that employee fraud is on the rise.

Pressure Employees under extreme financial or personal pressure are more likely to commit fraud. The pressure can come from external sources (e.g. personal financial difficulties) or from internal sources (e.g. work financial performance). During the Covid-19 global pandemic, the financial and personal pressures on employees have not been as intense as they are now for a generation, with the inevitable result being that some employees can see no way out of the financial hole in which they find themselves, other than stealing from their workplace. Employers should look out for some typical signs of employees:

- going through a bad relationship break-up which can be very detrimental emotionally, mentally and financially!

- living beyond their means (arriving to work in a brand-new Porsche, going on fancy holidays three times a year, or buying that second home in Italy)

- moaning about having to financially support other family members

- asking for advances on monthly wages (more than once)!

- (in Hong Kong) making regular trips to Macau casinos (it happens a lot)!

- complaining about the cost of living (e.g. rent, school fees, medical bills etc.)

Rationalisation Employees tend to rationalise what they know (or maybe not know) to be dishonest conduct by justifying the wrongdoing in their own minds – some examples being:

- “well, I didn’t get that pay rise I deserved this year”

- “Bob got awarded my bonus”

- “everyone else is doing it during the down-turn”

- “every business budgets for a bit of pilfering, so it’s my turn”

- “I’ll just take this chunk of cash instead of pressing for my (deserved) promotion”

- “I’ll somehow claim this as a business expense, as I need this new motorbike to get to work on time”

- “what I’m doing isn’t really that illegal”

- “the company is so rich, they won’t miss the money – it’s a victimless crime”

Opportunity The easier it is to do, the easier it is to get away with it, so the more likely it is to happen! In our experience, it is often the long-standing, trusted employees who are given the tools to commit fraud and who find it hardest to resist temptation if they are already sitting in the other two points of the Fraud Triangle. Compliance systems are under more pressure than ever with remote and home working, and with out-of-the-ordinary business practices being used more often to adapt to the difficult market conditions, all of which combine to make it harder to prevent and detect fraud. Some ‘top tips’ for minimizing temptation – especially during the pandemic:

- restrict (even more than usual) access to the company’s bank account

- do not circulate computer passwords

- (in Hong Kong) ensure that the company ‘chops’ are under lock and key (not kept behind the reception desk – as in one case we handled)!

- do not allow the same individual(s) to be responsible for sending out invoices, collecting payments, and sending out receipts – they are different functions, which should be handled separately

It’s all very well companies having sophisticated codes of conduct and anti-fraud policies in place, but they are useless as preventative measures if they are just signed by employees after a lunchtime training session, then stored somewhere on the intranet, and never effectively implemented. As always, prevention is better than cure, so:

- senior management must openly hold themselves out as more accountable to set the tone within the organisation

- companies should create and develop an open corporate culture where employees feel that they can open up about their individual difficulties or offer up honest opinions without fear of ridicule or retribution

- organisations which instil a sense of purpose and team accomplishment should make their employees less likely to stray from the group moral compass

- companies can give employees an ‘ethical nudge’ by creating corporate social responsibility schemes which the employees can all buy into as a group

At the end of the day and for all sorts of reasons, good people can do bad things, just because they feel that they have no other way out of the (usually) financial predicament in which they find themselves. However, if they feel that they can talk about their difficulties internally without fear of reprisal, they are far less likely to succumb to the pressure, rationalise any misconduct, or to fall into temptation, which is always by far the worst option as it is invariably only a matter of time before the law catches up with them!

Please contact Kevin at kevin.bowers@bowers.law if you have any questions about this Room 228 Newsletter.

This Newsletter is not intended to be and should not be relied on as legal advice. You should seek professional legal advice before taking any action in relation to the subject-matter of this Newsletter.